Is It Better to Pay Off Subsidized or Unsubsidized First

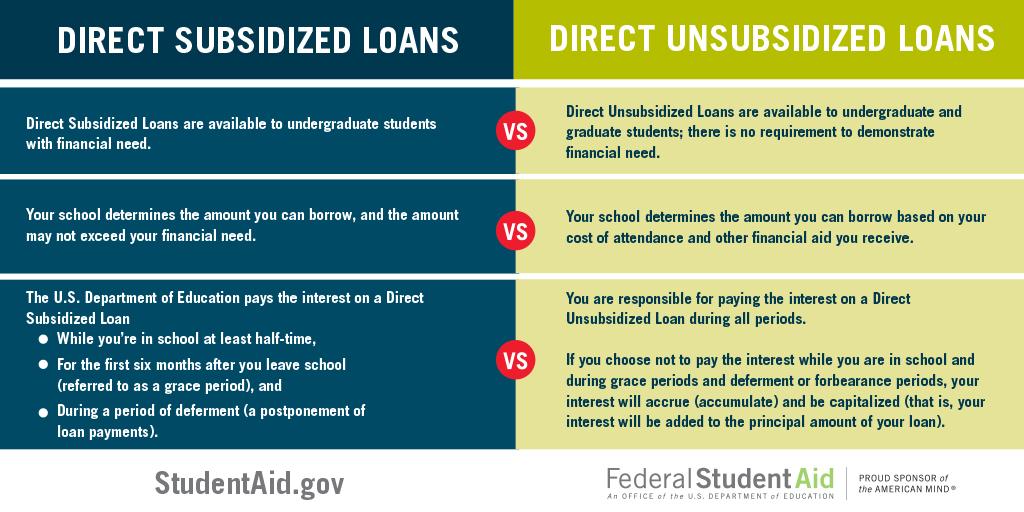

Subsidized loans are better than unsubsidized loans because you dont have to pay for any interest that accrues during your enrollment plus the 6-month grace period after finishing. The current interest rates first disbursed on or after July 1 2021 and before July 1 2022 for Direct Subsidized and Direct Unsubsidized Loans are 373 Undergraduate Student and 528 Graduate or Professional Student.

Subsidized Vs Unsubsidized Student Loans Know The Difference

Because an unsubsidized loan continues accruing interest while in school the balance of your unsubsidized loans will be larger unless you paid the interest while in school.

. However if the interest rate is very low you wont have much capitalization by the time youre in repayment. So if all else are equal you should prioritize unsubsidized loans first. When prioritizing loan repayments its a good idea to repay your direct unsubsidized loans first before paying back your direct subsidized loans.

Alternatively if students stop enrollment or their education falls below half-time they become eligible for repayment. For example you might pay down the highest rate unsubsidized loans first then highest rate. Which loan should I pay off first subsidized or unsubsidized.

Because an unsubsidized loan continues accruing interest while in school the balance of your unsubsidized loans will be larger unless you paid the interest while in school. Generally speaking undergraduate students should look at pursuing a subsidized loan first. Unsubsidized student loans on the other hand charge interest during in-school deferment and grace periods.

If you have a mix of both unsubsidized loans and subsidized loans youll want to focus on paying off the unsubsidized loans with the highest interest rates first and then the subsidized loans with high-interest rates next. If you have a mix of both unsubsidized loans and subsidized loans youll want to focus on paying off the unsubsidized loans with the highest interest rates first and then the subsidized loans with high-interest rates nextOnce these are paid off move on to unsubsidized loans with lower interest rates. Generally both loan borrowers start repayment six months after graduation.

Uncle Sams money for higher education is not unlimited and not even a students ability to borrow it. How much interest youre charged and how it accrues over time plays an important role in prioritizing which student loans to pay off. It makes sense then to work on paying off these loans first.

Subsidized student loans do not accrue interest while enrolled in college at least half-time or during deferment periods. 18 months to 12 months I believe somehow to make it work but literally said the words I dont want you to have to pay any interest. When prioritizing loan repayments its a good idea to repay your direct unsubsidized loans first before paying back your direct subsidized loans.

Because an unsubsidized loan continues accruing interest while in school the balance of your unsubsidized loans will be larger unless you paid the interest while in school. Pay subsidized or unsubsidized loans first. If you compare a Subsidized vs Unsubsidized loan you might notice differences in the repayment process.

You should pay the unsubsidized loans first if you are still in school or on that 6 month break before they start charging you because unsubsidized loans acquire interest regardless if you are in. And pay it all off every month so its not like Im completely devoid of paying debt. However you can borrow more money with unsubsidized loans.

Unsubsidized loans on the other hand start gathering interest as soon as you borrow them. Pay off unsubsidized loans with low interest rates Again an unsubsidized loan means that the interest accrues from the time of disbursement. When prioritizing loan repayments its a good idea to repay your direct unsubsidized loans first before paying back your direct subsidized loans.

With unsubsidized and subsidized loans you could follow the same snowball or avalanche approach. This is the better deal. Should You Pay Subsidized Or Unsubsidized First.

Should I pay off subsidized or unsubsidized loans first. The biggest advantage of subsidized loans is how interest is applied. An ideal solution if you have a lot of both unsubsidized and subsidized loans is to pay them off first with the highest interest rates and then go after the subsidized loans.

In a subsidized loan the federal government pays the interest on the loan while you are still in school at least half-time. Once these are paid off move on to unsubsidized loans with lower interest rates. When an unsubsidized loan is accruing interest the amount of interest is added to the principal and youll have to pay interest on the increased principal amount this is called capitalization.

Is It Better To Pay Subsidized Or Unsubsidized Loans First. A subsidized loan doesnt start accruing interest until youve graduated and youre out of deferment. For this reason pay unsubsidized low interest loans after subsidized high-interest loans.

Regardless of which one you pick only take out as. Once these are paid off move on to unsubsidized loans with. There are limits to the amounts of loans for each year of school and for all the training of the student.

Do you want to pay off subsidized or unsubsidized loans first. The loans will be repaid so switch them to unsubsidized ones with low interest rates. The interest rates are fixed for the life of the loan.

But similar to subsidized loans you dont have to start paying off unsubsidized loans until after your grace period ends. But with proper financial planning an unsubsidized loan isnt as terrible as you might think. If all else equal always pay unsubsidized first because the government will pay the interest on subsidized loans whole youre unemployed or going to school.

If you have a mix of both unsubsidized loans and subsidized loans youll want to focus on paying off the unsubsidized loans with the highest interest rates first and then the subsidized loans with high-interest rates next. Start With Your Unsubsidized Loans. When prioritizing loan repayments its a good idea to repay your direct unsubsidized loans first before paying back your direct subsidized loans.

Half-time enrollment typically means taking at. Because an unsubsidized loan continues accruing interest while in school the balance of your unsubsidized loans will be larger unless you paid the interest while in school.

Top 5 Questions About Subsidized And Unsubsidized Loans Financial Avenue

Federal Student Aid On Twitter What Is The Difference Between Subsidized And Unsubsidized Loans Find Out Http T Co Gz9nnvpavy Http T Co Nsig6dmckh Twitter

Subsidized Vs Unsubsidized Student Loans Repayment For Each Type Student Loan Forgiveness Student Loans Federal Student Loans

Comments

Post a Comment